December 30, 2016-Now I know that the Ackmanaholics, The “Knuckleheads in bathrobes” OR the “Zombies in Pajamas” as we now call them will be screaming holy bloody murder for going after Ackman and reporting his divorce, but hold on a minute, wasn’t Ackman and his stooges all over the internet a few years ago when a Herbalife distributor committed suicide? Didn’t they say this was a sign that the cookie is crumbling. That Herbalife was falling apart? And didn’t they do this even before the mans funeral and with total disrespect to his family and friends??? So good for one is good for all. Ackman and his stooges obviously have no regard for people. In this case, I do feel sorry for Mrs. Ackman and the children. The good news is that they will be better off.

It now looks like Bill Ackman may be known as a 1/2 billionaire.Normally I wouldn’t gloat over a divorce, as mentioned above, Ackman and his cohorts wasted not time in going after John Peterson, the Herbalife rep who committed suicide. Ackman and his pathetic followers smelled blood and were looking at their short play. But as usual, as is always the case with Ackman it backfired. Nevertheless, if Ackman and his irresponsible freak followers with no morals and total disrespect for the deceased and their families want to act this way, BRING IT ON!!!!!!!

Now Mrs. Ackman is squeezing the life out of Billy-boy.

Add in his losses on being short HLF, long CMG and long VRX, investers bailing out of Pershing Sq like people running out a burning house, the future looks very dim for Billyboy. Now add in Mrs. Ackman peeling away cash from this guy. It won’t be much longer before Billy has to fold.

Check out the article about Ackman’s divorce and how much it is going to cost him. Couldn’t have come at a worse time. Mrs. Ackman’s gift to her hubby? Or to us??

http://www.vanityfair.com/news/2016/12/bill-ackman-divorce

So I would like to make the same statement about Billy Ackman that Ackman made about that now deceased Herbalife rep. Is this a sign that Ackman and Pershing Sq are falling completely apart? Sure looks like it. I wish Mrs. Ackman well. Apparently she took a cue from so many Pershing Sq investors who also bailed on Ackman. I can’t blame anyone for walking out on Billy-boy. In fact, I support it. I do feel for Mrs. Ackman and the children. However, I can’t help but think how much better off they will be away from Billy-Boy.

http://www.vanityfair.com/news/2016/12/bill-ackman-divorce

It is not secret that I am no Bill Ackman fan, in fact quite the opposite. For the last 4+ years, I have been hammering home that Ackman was totally clueless on his HLF short play and contrary to what he tries to imply, he is not doing this to benefit anyone but himself.

For the real dope on Bill Ackman, go to

http://www.therealbillackman.com

In December, 2012, Ackman’s Pershing Sq porfolio was bleeding red. Then came the infamous presentation (Ackman informercial) at the Sohn Conference where Ackman announced his $1 billion short POS on HLF and predicted that HLF stock was worthless and going to zero. And of course he claimed Herbalife was a ponzi, pyramid scheme.

This presentation was done just 2 days before options expiration for DECEMBER, 2012. How convenient! HLF stock tanked on the news dropping to as low as $24, a whopping 45% drop in one day and magically Ackman’s Pershing Sq Portfolio went from negative to positive. Walla!

Herbalife heard about the so called Ackman presentation (informercial) but Ackman denied them an opportunity to be there and offer a point/counterpont discussion. Hmmm. I wonder why Ackman didn’t want anyone from Herbalife there. Probably because it was to close to options expiration, aside from his huge short POS, Ackman also loaded up on puts. Didn’t want to risk the truth coming out and anyone showing the facts and exposing Ackman’s lies.

Anyway, since then I have adamant on going after Ackman and his brain dead shills. People who act like junkies mindlessly supporting someone merely to get in on what they see as a get rich quick scam to profit by being short and buying puts on the wild assumption that Ackman might be right or at least move the market. How many shorts have been devastated following Ackman’s failed strategy?

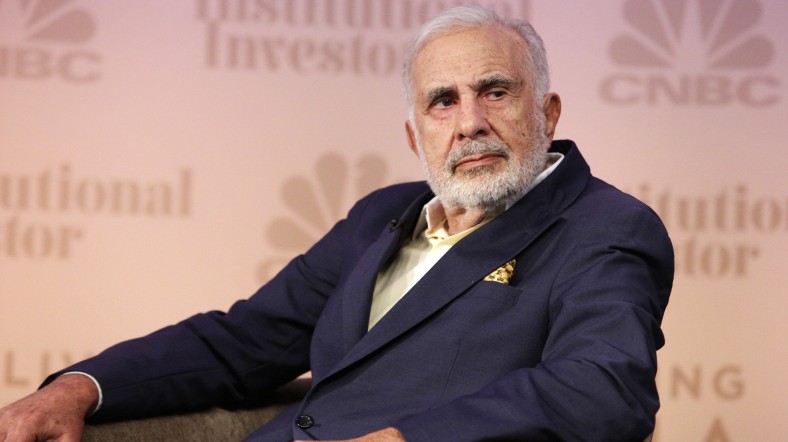

Earlier this week, Ackman and his goons recklessly lied and said that Carl Icahn was selling most or all of his shares. This sent HLF stock reeling, dropping by as much as 7% untill the truth came out.

Still not done, Ackman came out on FRIDAY spewing more garbage and showing once again that he is a very desperate man and as I have always stated, A LYING FRAUD! He will do anything to try to turn this reckless HLF short POS around and try to prove that he is right when he is oh so wrong. Ackman played the HLF longs. But late Friday afternoon, “Uncle Carl” Icahn came back and played Ackman and the shorts.

Herbalife Ltd. backer Carl Icahn waited until after Friday’s market close to contradict fellow billionaire Bill Ackman, spending the day adding 2.3 million shares to his stake in the nutrition company as its stock tumbled.

In this latest tussle between the outspoken New York activist investors, the only clear outcome is that Icahn now owns even more of Herbalife: 21 percent. Ackman had said Friday that Icahn was looking to sell his stake, not add to it.

Meanwhile, Ackman’s hedge fund, Pershing Square Capital Management, is approaching the four-year anniversary of its $1 billion-bet that Herbalife is a pyramid scheme destined to collapse.

“Bill Ackman tried to play us this morning, and Carl Icahn played Bill Ackman this afternoon,” said Tim Ramey, an analyst at Pivotal Research Group and a longtime defender of Herbalife. “It’s so beautifully played on Icahn’s part.”

Icahn has been publicly assailing Ackman’s attempted evisceration of Herbalife — on stages, television, in documentaries and online — since a January 2013 CNBC phone-infight . That July, Icahn told a conference he decided to look into Herbalife because he wasn’t “a great fan” of Ackman.

A year later at the same Delivering Alpha event in New York, both billionaires took the stage together and said their feud was over. Days later, Ackman delivered an emotional , nearly four-hour anti-Herbalife presentation that backfired — lifting the shares 25 percent.

Ackman who has always had an inflated opinion of himself while underestimating others, pretended to be on friendly terms with Icahn. Only days later he went after Herbalife and Icahn again. But as is usually the case with Ackman, it backfired badly on Ackman.

Public Short

Ackman has waged a public short campaign against Herbalife since December 2012, saying it should be shut down. Along with setting up a $1 billion wager against the stock, he hired investigators to look into the company’s business practices and gave public presentations making his case, while prodding regulators to conduct their own review.

Icahn took the other side of the trade in early 2013, snapping up 18 percent of the company’s shares and defending its multilevel marketing model — in which products are sold both to consumers and new distributors. Herbalife later let Icahn name five board members as its largest investor.

Herbalife surged as much as 8.3 percent to $65.54 in late trading Friday, after Icahn posted a statement about his position in the company on his website. The shares dropped 2.3 percent to $60.50 in regular trading in New York, trimming an earlier loss of as much as 7.8 percent.

Shares Tumble

Ackman sent Herbalife shares tumbling when he said Icahn was looking to ditch his holdings. In an interview with CNBC, Ackman said investment bank Jefferies Group LLC approached him about buying a portion of Icahn’s Herbalife shares earlier this month.

He said he considered buying some of Icahn’s stock if it would help get Icahn completely out of his position. Ackman later confirmed to Bloomberg News that he didn’t buy any of Icahn’s stock and would have quickly sold the shares if he had.

“Completely contrary to what Bill Ackman stated on television today, I have never given Jefferies an order to sell any of our Herbalife shares,” Icahn said in his statement, in which he disclosed adding 2.3 million shares. “I continue to believe in Herbalife: It’s a great model that creates a great number of jobs for people.”

Ackman’s ‘Malady’

Icahn’s statement — which critics noted didn’t directly address whether Jefferies had quietly shopped the stake for buyer interest — went on to lambaste Ackman’s fixation on the company.

“Ackman may be a smart guy, but he has clearly succumbed to the same dangerous (and sometimes fatal) malady that afflicts many investors -– he’s developed a very bad case of ‘Herbalife obsession,”’ he said. “Obsessions concerning the value of stocks are the undoing of many investors because they often blind you to the facts, and it becomes impossible to see the forest for the trees.”

Ackman maintained his bet against Herbalife even after the maker of weight-loss shakes and supplements reached a $200 million settlement with the U.S. Federal Trade Commission last month. He said that the terms of the agreement — which Herbalife hailed as an acknowledgment that its business model was sound — would cripple the company and cause it to collapse.

Internal Thinking

Icahn’s response to the FTC agreement noted that he was allowed to raise his stake to as much as 35 percent — something Ackman had previously opined wouldn’t happen.

“It amazes me that a guy who hasn’t any knowledge of my internal investment thinking believes he is in a position to go on television to tell the world what I AM thinking! Amazing!” Icahn said in Friday’s statement.

“He has no right to do so, and even worse, I’m sure his unsubstantiated, obsessive comments, especially about Herbalife, have cost investors a great deal of money over the last few years.”

Multilevel Sales

Meanwhile, Herbalife, the object of this billionaire battle, has repeatedly denied Ackman’s accusations. The company declined to respond to Ackman’s comments on Friday, though Chairman and CEO Michael O. Johnson quickly welcomed Icahn’s announcement.

“We appreciate the support of all of our investors and are particularly grateful to Carl Icahn and the conviction he shares, and continues to show in our business, as demonstrated by today’s significant increase in his stake in the company.”

The dispute over Herbalife’s business centered on whether there was legitimate demand for its products by actual customers or whether its sales came mostly from contractors who bought the products in hopes of making money by reselling them.

The FTC’s findings backed up many of Ackman’s claims, saying that the business was driven more by member recruitment than by retail sales and that a large number of its distributors lost money. The agency is forcing changes that could make it more difficult for distributors to profit. Herbalife will now have to depend on retail sales, which are to be verified by receipts, instead of bulk purchases by members.

Still, Herbalife has remained upbeat about its prospects. Earlier this month, the company posted second-quarter results that topped analysts’ estimates and said it expects to overhaul its business practices globally in response to the settlement. While the terms of the deal affect only its U.S. operations, the company said it would likely roll out some aspects of the agreement worldwide.

“Carl is the confidence behind Herbalife,” Ackman told Bloomberg before Icahn’s statement. “Once he’s out, the confidence is gone and the company collapses.”

And Ackman is the confidence behind Herbalife shorts. That confidence is rapidly fading. Once it is all gone, the HLF short thesis collapses and then we have the long waited MOASS.

So what happens when trading resumes Monday, after “the confidence behind Herbalife” — an 80-year-old worth $19 billion — has bet another $137 million on its future?

Ackman is holding on to his reckless HLF short POS by his fingernails. Can’t hold on for much longer. Ackman has been liquidating other positions. It won’t be long before he is forced to cover on his senseless poorly researched HLF short POS as well.