June 9, 2017

Oh wow what a difference a few days makes. On Sunday nite and throughout most of this week, the Ackman goons were wetting their pants and all over the internet with their all so often erroneous claims of doom and gloom on Herbalife (HLF) or to quote Allan Greenspan, “irrational exuberance” much ado over nothing.

We know that Herbalife was going to make a announcement on Monday and they did. So what? Is Herbalife the only company to pre-announce that earnings may be disappointing? Nope. Irrational exuberance.

Herbalife did sell off on Monday and then came back somewhat still ending in the red for that day. On Tuesday. HLF came back and was in the black today for most of the day. HLF ended up slightly in the red for the week but not bad considering that the Ackman goons were predicting on Sunday night that HLF would close the week in the 50s. But are they ever right? Nope. Just irrational exuberance and lack of experience. Not to mention cheap scare tactics.

Let’s also put to rest the rising short interest crap. Short interest on Herbalife is still way below 2013 levels and newest stats are not available. Pure conjecture by the Ackman goons and perhaps Ackman himself.

BULLS STILL IN CHARGE. ICAHN STILL SQUEEZING THE LIFE OUT OF ACKMAN

Despite the hype, hoopla and total crap primarily on FAKES NEWS Seeking Alpha and other blogs, Ackman is still deeply, deeply in debt and on the losing side of his reckless HLF short position.

BETTING ON ZERO BOMBED AS PREDICTED

Last March, the Ackman goons or perhaps goon, Chris Irons aka quoththeraven were once again wetting themselves (himself) over the release of ‘Betting on Zero’ Many of us predited it would bomb. Irons predicted that would be, and once again imitating his idol Bill Ackman, a “Herbalife Deathblow” (hahahahahaha) and would educated the unknowing public as to the terrible travesties of this horrible company called Herbalife which must be eradicated from the face of the earth! LOL!!!!

Of course, as usual, Irons assumes he knows something that nobody else does and also incorrectly assumed that the general public was in the dark about Herbalife and not aware of Ackman’s Fairytale, reckless HLF short play and lies about Herbalife.

‘Betting on Zero’ has been dropped from the few theaters it was showing in. And now, in case you missed it, ‘Betting on Zero’ is now available on netflix. But for how long and who cares? Pretty soon Ackman will be paying people to watch it. Yeah, it is that bad.

Meanwhile back on Wall Street, things are still looking very bleak for Billy boy Ackman. Despite his relentless attacks all week, HLF showed a minor selloff. Based on the way the Ackman goons inaccurately painted the picture, we would have expected a $20 drop at least on HLF. Never happened.

The fact is, investors have lost faith in Ackman. His investors have been redeeming for quite some time and were still redeeming this week. Pershing Sq assets have been cut in half.

Bill Ackman’s new nickname could be “SLASHER”

Entry into Pershing Square funds is not cheap. There is a huge capital investment, nosebleed fees, high commission, huge back end fees if and when you get smart and redeem and when you do get smart and say you want to redeem, Ackman’s snake oil salesmen will do everything possible to prevent you from getting your hands on your own money!

Why are so many Pershing Sq investors still redeeming and so few new investors buying in? Lost faith in Bill Ackman.

HINT: This is why new investors should not be buying into this fund and all the more reason why current Pershing Sq investors should redeem and get out a.s.a.p.

Better to get out with less money than lose it all. Betting on Ackman’s investment expertise is a recipe for disaster.

Better to bet on a blindfolded monkey throwing darts than on Ackman’s ability to pick winning stocks.

An old axiom in the the markets is “Never try to catch a falling knife.” No where is this more accurate than with Pershing Sq in which investment returns have fallen sharply over the last 2 years and still dropping.

In fact, it is now more apparent than ever that Ackman is pulling his hair out trying to save Pershing Sq and attempt to prevent it from becoming Gotham Partners II.

Notice how Ackman is now going back to 15 year returns. Why? Because over 15 years his funds do show a profit. Big problem though. The investments in those early years 10-15 years ago have burned out. The big question all Pershing Sq investors have now is;

“What have you done for us recently Ackman?”

Answer is Lose $$$$$$.

A new motto is:

Lose Money Now – Ask Ackman How!

And how true.

We also now know that Ackman has sold off a lot of his investments. Most of which he was bragging about not long ago which went sour. If in fact Ackman ever did really have any magic, obviously that magic is now gone.

Most feel that Ackman never had any real magic or great strategies, he was just plain lucky. Like the proverbial blindfolded monkey. He is no Buffet. My 12 yr old gets better returns in his proxy account.

If you have been a investor in Pershing Sq and mirroring Ackman’s trades, you have seen double digits losses over the last two years just as I and others predicted back in 2014. I see Pershing Sq as showing another major loss in 2017.

Those of us who have been in the game even prior to the Ackman-Herbalife saga, know very well about Ackman and his many mistakes. Yes he has had a few hits, perhaps one big hit. But so many misses. I honestly don’t know any other hedge fund manager who has been more wrong more often than Ackman.

2 weeks ago, Ackman was bragging about some “Mystery” investment that he invested in and is excited about. He wouldn’t say what it is which I believe is a red flag suggesting that this is just a smoke screen to try to slow down the massive redemptions he is getting at Pershing Sq.

However, even if Ackman does have a investment that has grown by 20%, how much does that affect his fund overall? It may bring it to a 2%-3% return. I repeat, Ackman’s fund at Pershing Sq has been down double digits 2 years in a row. So at best, a 3% return in 2017 if that happens will leave Pershing Sq investors and others who follow Ackman’s reckless trades with a 3 year loss of about-37%. I don’t know of any other hedge fund or other manager who has done anywhere near this poorly.

Who wants to settle for 2% returns especially with such a huge up front investment and incredible inflated fees, commissions and other fees? And Ackman tries to play the nice guy. The good guy. The knight on a white horse coming to rescue those poor suckers who bought into Herbalife’s “pyramid” scheme.

If you ask me, Ackman is the one running a scheme. What he does and is doing makes pyramid schemes, of which Herbalife is not one, look legitimate. I think it’s time the SEC looks into Ackman. Does a audit. Check returns and any profits with investors. Contact all of the Pershing Sq investors who redeemed i.e. dumped their worthless Pershing Sq fund investments and moved on. Let’s see how many victims we have over there. Should be interesting. And perhaps the SEC may want to go back in time and research what really happened with Gotham Partners and how many investors were robbed on that deal.

AND……….As Herbalife continues on it’s growth mode, this will eat into Pershing Sq even more. Not to mention Ackman’s other investments are not performing very well.

Don’t put too much credence into Ackman’s claim that he has some super investment that has grown by 20%. Ackman has a poker face and talks a lot. There is a reason why he has been called “A modern day version of PT Barnum” It is all show and drama. Look at his track record. Yuck!

Ackman also maintains a bearish attitude towards Herbalife no matter how wrong he always turns out to be. I am certain that he will maintain a long term short position on HLF even when it takes Pershing Square to 0 and becomes Gotham Partners II.

Pershing Sq had nearly $20 billion in assets a year ago. Now it is down under $10 billion and declining fast. More and more Pershing Sq investors are redeeming daily. And few new investors are buying into this horrible fund and for good reason. It is expensive, has nose bleed fees and commission and has a horrible, absolutely horrible return. Most of all, look who manages it. Not an enviable record. And who wants to pay so much to lose $$$? You don’t need Ackman for this. In fact, novice investors would do much better to invest on their own and generally massively outperform Ackman. My 12 yr old son does better with his proxy account.

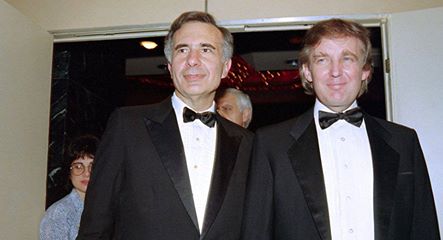

Carl Icahn gave Ackman some good advice months ago……..

Carl Icahn, despite the negative attacks against him from smaller billionaire with a rapidly declining net worth Billy Ackman, tried to give Billy boy some good advice months ago. He said that Ackman had gotten too emotional over the HLF short play and was trying to win a bet against Herbalife that was impossible He said that Ackman had “lost perspective” and indeed he has. And now obviously Pershing Sq is paying for Ackmans ineptness.

We all know that Ackman was responsible for taking Gotham Partners down. The once hedge fund office is now a dress factory. Ackman takes miscalculated risks and loses way too often. And he loses B-I-G Hence, so many of his Pershing Sq investors are redeeming shares and washing their hands of Ackman. Who can blame them?

Just a few months ago, Pershing Sq took a huge hit at the expence of Ackmans foolishness and bad investment judgement with a $4 billion+ loss on VRX. And all this time Ackman was telling his sheep to hold on. He had carefully researched this company. The stock would bounce back. Or so he said. Ackman doubled down by buying more shares as the stock dipped incurring even more losses. Finally selling when $VRX hit $10 for once again a $4 BILLION +LOSS. Ouch! Bad move. Bad judgement. But it wasn’t his first and won’t be his last.

But does Ackman really know what he is doing in investments? Doesn’t look like it.

Do you remember when VRX used to trade @ $33.51 just a few months ago and Ackman was still so bullish on it? Ackman bought VRX at $270 and rode it all the way down to $10 before finally selling. Does this sound like good judgement to you?

For more on this wacko, go to this website……….

http://www.therealbillackman.com

Today, Herbalife (HLF) is up again. Make that three days in row. Ackman and his shills are wrong again. I don’t care if they hold on to their reckless short HLF positions. Hey, it’s their money not mine. I bet their phones are ringing from brokers with Margin Calls.

In other news, TESLA is also up today. Didn’t Seeking Alpha with their FAKE NEWS STORIES tell us to sell that last week? And what did I say? Hold on right? So once again, irregardless of Herbalife and HLF stock, who is right and who is wrong as usual, the FAKE NEWS on Seeking Alpha which is why we call it FAKE NEWS!. qtr research needs to move out of Chris Irons bedroom, out of stock market speculation and Chris Irons needs to move into something else, like maybe mowing grass? Perhaps he can do that without screwing up.

December, 2012 will go down as the worst time in Bill Ackmans life and will indelibly be etched in time as the time when Bill Ackman made the worst mistake of his life—–Lying about Herbalife.

Every investor/trader shorts stocks from time to time. Nothing wrong with that. Typically, savvy, sophisticated, educated and successful traders will research the companies and stocks before shorting them, they will use technical analysis and other tools to determine whether a stock is ripe for shorting. Heretofore, no one has ever shorted a stock that successfully beat earnings 22 quarters in a row, with a company that was and still is in a huge growth mode and used old, outmoded and debunked crap to create short position and then call it “A illegal PYRAMID SCHEME and their stock is headed to Zero” as Billy boy Ackman did to Herbalife at that now infamous informercial he mislabeled a presentation back in December 2012.

Billy boy Ackman is not what he claims to be. He has been apropiately named “The Worst of Wall Street” Just ask anyone who follows his trades or anyone of the many who have redeemed shares and walked away from Pershing Sq. because of Ackman’s very bad investment decisions.

http://www.therealbillackman.com

*FACT-Ackman’s thesis was all wrong and still is. Where is Sean Dineen these days????

*FACT-Pershing Sq was having a bad year in 2012 and Ackman need to work some magic so squew the numbers. So why not go after Herbalife? So he thought.

*FACT-Ackman did open a huge $1 billion plus short POS on HLF and allegedly bought December, 2012 puts.

*FACT-The Sohn Conference Informercial was conducted just days before options expiration

*FACT-Ackman would not allow anyone from Herbalife to be in attendance at this Sohn Conference Informercial to offer a point/counter point discussion. What was Ackman afraid of? Obviously the truth and he wanted nothing to ruin the big gains he was expecting from those puts and short POS before the end of December to sugar coat prospectuses to lure in more victims into his Pershing Sq fund scheme(Or is that Perishing??)

Ackman sure created an incredible Fairytale with his FAKE NEWS story on Herbalife and he continues with that FAKE NEWS story to this day. Big problem though: Ackman has been taking a licking on this insane, crazy, reckless, winless HLF short bet.

Despite the hype and drama, bringing in his buddies which included 2 AGs and a US senator, numerous appearances on CNBC, conferences and memos, blogs etc. after nearly 5 years Ackman is deeper in the hole with his HLF short than ever before and barely hanging on by his fingernails

To date Ackman has lost an estimated $7 million on this HLF short bet. To make any profit on this at all, HLF has to drop to $30. To make a huge profit, it has to drop to under $20. After the Sohn Conference Informercial, HLF did drop as low as $24 but rallied back up. And then when Carl Icahn came on the scene, it really rallied and went as high as $84 in January 2014.

Through it all, Ackman has been appearing on CNBC, sending out memos, apearing all over, frantically trying to find someone who will pretend to be a Herbalife “victim” still says “Herbalife is a pyramid scheme and the stock is going to zero” and everytime he says that, HLF goes higher, higher and higher. While HERBALIFE continues to grow constantly adding more and more and more preferred customers and distributors.

Ackman would be better off trying to shovel sand off of a beach. Same result!

Clearly Ackmans fairytale, and that is all it ever was has turned into a nightmare for this failing billionaire. More and more Pershing Sq investors are redeeming shares, fewer new accounts are being opened. Ackman had no earthly clue what he was doing when he started this nor did he care that he as putting tens of thousands of HLF longs at risk, 4.5 million Herbalife distributors, 8,000 Herbalife employees without a job or a business opportunity that they worked long and hard at and potentially leaving millions of happy customers all over the world without a product. Why? All because of Greed & Ego.

While Ackman bashes Herbalife, authentic billionaires who truly understand network marketing, business and want to help people succeed, fully support it.

I value the word of these wise and very successful people over shyster, scammer Billy Boy Ackman.

Regarding that short bet, Yeah I know Ackman claimed he was going to donate any profits to charity. C’mon.

Who invests $1 billion to short a stock and then passes it on to charity? This was all smoke and mirrors. His eyes were bleeding green and he was chopping at the lips thinking of the billions he could make if this scam against Herbalife really worked. And he would look like a do goody to the uneducated and uninformed. He would look like the “good guy” when he reality, he is quite the opposite.

Thank God it didn’t work.

Herbalife posted first quarter earnings on Thursday that were a blowout substantially exceeding analysts expectations and putting to rest the concerns that the FTC determination would seriously impact Herbalife going forward.

AS many of us have been stating for some time, there would be no serious impact. Herbalife has always been focused on retail sales along with recruiting. Sure there were some shysters who did not follow company guidelines and broke FTC rules by front end loading and selling worthless tools like stale leads, web sites and trying to create telemarketing heroes out of people with no previous sales experience and offered very little if any valuable assistance. Once reported, these people were terminated and actually went with other companies.

A walk down memory lane

Interesting is that when these violaters were reported and terminated by Herbalife, the Ackman shills were all over the old Yahoo message boards as well as other personal blogs, websites stating “Top leaders leaving Herbalife” This started back in December 2012. They never mentioned that these “Top Leaders” were terminated by Herbalife. Surprised? I wasn’t

The same garbage, not surprisingly started to appear in the Seeking Alpha Fake stories. Back then, there were as many as 5 anti-HLF “stories” appearing daily in SA. I challenged the authors to retract their comments and indicate that these “top reps” were actually terminated. Of course they never did. It would take away from their drama and lies. Eventually though the truth came out. Especially when Carl Icahn came on the scene in January 2013.

It should be noted that these anti-HLF people (probably one person with a bunch of aliases) were predicting HLF would hit zero by March, 2013. Hello. It is May, 2017. And we are a long way from zero.

They also constantly reiterated Ackman’s insane line and made it their own:

“HLF is going to 0 and I have a strong sell on it.”

Oh really? What qualifies him to set a target price or a rating on it? Answer: Nothing!

Chris Irons aka Birdbrain quoththeraven

The big mouth in all of this tried to make it appear as though he was a big roller. Some big time analyst or celebrity. Using an alias, he even tried to suggest he was Hugh Heffner! LOL! In fact, by his own admission he later, about 2 years later with help from Herbie admitted he was in fact “just a little guy” Yes indeed but he never revealed just how little. That was a few years ago. Now he is trying to play the “big roller” role again and wants some people to think he really knows something. Clue: He doesn’t

Of course I am referring to Chris Irons aka quoththeraven. I know you already knew it. And as a another walk down memory lane, who was it that revealed his real first name was Chris and was about to reveal his whole name until he did it himself, embarrassed by my letting the cat out of the bag? Of course, I was the one. And keep in mind, prior to all of this, Chris Irons aka quoththeraven tried to convince everyone that he would never, never, never,never, ever release him real name because he was getting so much hate mail and death threats. LOL—–The drama continued. So much bull. But once I let people know that I was about to reveal his real name, the so called “Hate mail” and Deaththreats” were no longer an issue.

Chris Irons challenges John Hempton to a debate. Really Chris????

Almost too funny, I got a memo from someone who still subscribes to Chris Irons aka quoththeravens twitter feed that he wants to challenge John Hempton, anytime, anywhere. While I can’t speak for John Hempton, I would love to see this happen. Is there any doubt that John Hempton would mop the floor with qtr??? Have you ever read any of quoththeravens (Chris Irons) stuff? He is not a very good communicator. Communication is not his forte at all. And he is never accurate. Hempton is. And Hempton understands investing. Chris Irons does not. He is always so wrong. My $$$$ are on Hempton, that is if Chris Irons actually accepts. But rest easy, he won’t. Just more of the drama.

I also received several messages from people sending me tweets that quoththeraven posted on his quoththeraven twitter page. I’ve been blocked and thankful for that just as I am continually deleting all of quoththeravens fake aliases from my twitter account. Interesting that this guy is so obsessed with following me.

Apparently on Thursday and Friday Irons came out like a raving lunatic. He couldn’t believe the earnings results nor how the street reacted and HLF soared. Was like Ackman’s ill fated “Herbalife death blow” in July 2014 (hahahahahaha) Some deathbow. Ackman looked like the fool he is as did Irons and whatever other followers Ackman has and HLF shorts. They were in shock. No response for about a week. Then Irons tried to spin it as he always does and the market laughed as they always do.

And BTW, 3 years ago Matt Stewart who many people think is just another alias for Chris Irons challenged Lenny Clements to a debate. Lenny accepted. But where was Matt?!!!!!! Lenny is a recognized authority on MLM. Stewart? He has an opinion and an agenda and is always wrong.

Matt also suggested that the Michigan AG and then all AGs across America would “pile on” Herbalife after two of Ackman’s buddies, both AGs initated action. That died very quickly and no other AGs did anything.

Paper Tiger Matt Stewart aka “The Chicken”

Chris Irons aka quoththeravens reaction to HLF earnings and market on Thursday nite and Friday.

Getting back to last Thursday, in Chris Irons world, earnings were bad. The sky was falling for Herbalife. Vindication for Ackman. Billy boy was right, yada, yada, yada. Funny the street didn’t see it that way as HLF SOARED in AH trading and continued to run up on Friday. Chris Irons aka quoththeraven is obviously living in his own fantasy world and no doubt he thinks the rest of the world is oblivious to the truth and we, as he puts it so often, “just don’t get it” LOL!!!!!!!!

Moving on to 2nd quarter earnings

All we heard from the Anti-HLF’ers since HLF’s 4th qtr earnings was that the FTC decision would show up in Q1 earnings. Well we just had them, Herbalife did extremely well and predictably, the new argument from the Herbalife bashers is that it will show up in 2nd qtr earnings. In case these guys missed it, Herbalife had a strong outlook for 2017 and spring is always a good time for Herbalife sales. People want to lose weight for summer beachtime and warm weather season. Not to mention their diversified product line of wellness, skin care and sports supplements. Look for 2nd qtr earnings to also exceed.

And of course when Herbalife exceeds earnings in Q2, then the bashers will say wait until Q3, Q4, (yawn)

Some people suggest that there is a final test coming to see which side is right, Ackman or Herbalife. Look at the last 4 1/2 years and look at 1st qtr earnings for 2017. Look at the reaction from the markets. I think it is obvious which side is right and pardon my grammar, but it ain’t Ackman. It is over for Ackman.

Carl Icahn has tightened his grip on Billy boy. Choking the life out of him. And Icahn is expected to be building on his position. Good bye Billy. You’re just a crybaby in the school yard. Always were, always will be.

Then some say that the bulls are winning for now. For now???? The bulls have been winning this since January 2013!!!!!!!!!!

Some keep bringing out the FTC fine from last June. “That Herbalife paid a $200 million fine in July to end the FTC’s investigation into whether the multi-level marketer of diet shakes was a pyramid scheme, as Ackman had accused.” Or that is how they say it.

Herbalife DID NOT pay the fine to end the FTCs investigation. FTC does not negotiate with companies that break the law. It was certain Herbalife distributors who broke the law and thus Herbalife ended up paying a fine for their improper actions. As already mentioned above, these distributors were terminated by Herbalife and their actions were never condoned by Herbalife and clearly against Herbalife policy. And most of that fine went back to Herbalife via fmr Herbalife distributors who returned to the company at the end of qtr 4 and beginning of q1 and used that money to buy more Herbalife products. Where were the co called “Herbalife victims” Only in Ackmans imagination.

In fact, Herbalife agreed to distinguish between distributors who sell the product and preferred members who merely want to use the products. Ackman, who knows little or nothing about network marketing or even how to pick stocks as evidenced by his huge losses on HLF short not to mention VRX recently and JCP, BORDERS, TARGET etc. scoffed at this idea and still claims that he sees HLF going to zero. But of course he does. His reputation is at stake and he has already lost approximately $700 million on this very reckless and poorly research HLF short play. And by the way, didn’t he also say he was bullish on VRX right up until he pulled the plug and sold it AT A $4 BILLION LOSS??? Ackman’s word is not his bond. His word is meaningless. He will say he is staying with his HLF short POS and then pull the plg and cover seconds later.

Herbalife reported 18,652 new members in North America in the first quarter, that number does not include the preferred members, a contingent that is several times larger than the distributors who actually sell the product to others. (Since Herbalife began separating these two categories in mid-January, 80% of new U.S. recruits signed up as preferred members, the company said.)

Previously, the Herbalife bashers claim was that Herbalife did not have any customers. Now Herbalife is proving they do. And now the Ackmanaholics Herbalife bashers look at this as bad news for Herbalife??????????? I don’t think so. It proves what Herbalife has been saying all along. That there are real customers. And I am certain that is the way the street saw it too based on the huge rally on Thursday AH and on Friday.

The total combined number of new U.S. distributors and preferred members is just slightly below what it was last year: In the first quarter of 2016, Herbalife disclosed 83,276 new North American recruits, of which about 80,200 were in the U.S. This year, the number was 78,900 for the same period, a decline of 1.7%, according to the company.

But, take into consideration the constant attacks by Ackman and his shills. Contrary to what Ackman and his shills say, this has leaked out to the general public and has affected Herbalife to some degree. Mainstreet is very much aware of this and not because of that Ackman informercial mislabeled a documentary. However, in spite of Ackman’s unsubstantiated remarks, Herbalife still continued to grow massively outpacing other network marketing-MLM companies in North America.

And of course, you have to take into account the current state of the economy and that USA had a presidential election in 2016. These things always create turmoil in the the markets. ALL told, Herbalife’s numbers were very impressive if not extraordinary.

Even before the quarter ended, there were signs that Ackman and other Herbalife detractors had underestimated the number of consumers amid the company’s distributor ranks. This is nothing new. In 2012, Ackman also underestimated and misjudged when herbalife reps would renew. It was a huge miscalulation.

When the FTC sent settlement checks earlier this year to supposed Herbalife “victims” who had supposedly never made any money as distributors, many of those who are now preferred members received them. Fans of the diet and nutrition products who never intended to resell them, some of those people said they planned to spend the settlement money on more Herbalife shakes and protein bars. Put another way, that FTC fine is being redirected back to Herbalife and Herbalife did not pay a fine to end the FTC investigation. The FTC does not operate that way. If Herbalife was guilty of any wrong doing, they would have been shut down. They weren’t. Case closed. Except in the minds of Ackman and his nutty follower(s)

Some will remember that Herbalife faced a major challenge back in 1985. Prior to the media attack then, Herbalife’s sales were over $512 million annually and were up to over $90 million a month in January, 1985. After the media attack, Herbalife sales dropped all the way down to only $10 million annually. This occurred in the 1980s. We all know Herbalife came roaring back. Also, I think that challenge was far more potent that what little weenie Ackman has offered. Herbalife is very resilent and has always proved that they are following the laws. Legal and ethical.

The FTC was yanked into this by Ackman via his buddy Sen. Markey. What was the result? Ackman lost again and we haven’t heard from Sen. Markey. I wonder if he is still close friends with ACKMAN after this embarrassment???? And how about those two AGs who were such good buddies with Billy boy, where are they? Also been very quiet.

Sen. Markey may be eating ice cream cones, but he has had very little to do with his (former??) good buddy Billy boy Ackman

As already mentioned, that FTC settlement to so called Herbalife “victims” has brought more former distributors and preferred members back to Herbalife and they are using that money to buy more Herbalife products. So the settlement is actually being redirected back to Herbalife. Interesting. Or at least much of it.

Also, Herbalife as we all know has their WinBack program in place which has been very successful bringing back more former distributors and preferred members. And of course Herbalife reps are hard at work building their businesses. I see the button “Lose Weight Now – Ask Me How” everywhere and Herbalife reps inviting people to their nutrition clubs. Speaking of which, I love the nutrition clubs. They are very powerful.

Another thing, spring is always the best time of the year for Herbalife as people are focusing on losing weight for summer and warm weather season. Expect sales to SOAR. And there are ads all over for Herbalife. Not to mention that Herblaife’s product line goes beyond just weight loss to sports supplements, wellness products, skin care and more. All of these things are positives and I expect Herbalife to have a OUTSTANDING 2nd quarter.

The squeeze on Ackman tightened up considerably last Thursday. Expect to get even tighter. MOASS is here.

I also enjoy playing with quoththeraven aka Chris Irons, Ackman, his braindead shills and the stupid and ignorant HLF shorts. Every single time they open their mouths via the internet with outrageus, ridiculous “what ifs” and “maybes” Doom & Gloom predictions, yet they are always wrong and I am always right. I look forward to doing it again next quarter and watching them be oh sooo wrong yet again. My guess is that Ackman will be gone by then. But this guy will continue. I guess he really needs that $35 an article and a penny per click from the garbage he writes on SA.

Hey Chris, so there is no hard feelings, I have some friends in Philly who may be able to help you. They are looking for a gardener and someone to mow their lawn. Probably will pay better than writing garbage on Seeking alpha and more ethical than promoting Pump & Dump pennystock junk. Of course, this is assuming you really do live in Philly and are fit enough to run a lawn mower and do garndening work. Do you really live in Philly? Perhaps that is total bull too.

Ackmanaholics and shills are really funny. No matter how many times they are wrong, which is everytime, they still maintain they are right and think they can manipulate t he market with their b.s. It never works! They are like the guy who hits himself on the head with a hammer. He should only have to do that one time to realize, “Ouch, that hurts.”

Herbalife had great earnings as I and so many other experienced investors indicated long before earnings was announced. I made it obvious that I was long a week before and was expecting great earnings. I increased my POS on HLF, bought calls, sold puts and bought more shares. And do you know how many companies would love to have the numbers that Herbalife produced on Thursday? Do you know how many MLM companies would love to acquire 83,276 new distributors just in North America in 1 yr and without the noise and distraction of that lunatic Ackman???

Clearly, what Herbalife did on Thursday was nothing short of mind boggling.

BTW, here are some of my other holdings. Obviously, I can’t put an image of my account on here. I know how to invest successfully. Unlike Ackman and Chris Irons. BTW, did you know that even though Chris Irons along with his idol Ackman, makes wise cracks about Herbalife reps, calls them “get rich quick money hungry scam artists” Do you know how he makes his living? He is a PUMPnDUMP pennsystock promoter.

And interesting too, in another tweet that I received made by Chris Irons aka quoththeraven, he indicates he wants the name calling stopped but then proceeds to name call Michael O. Johnson and new Herbalife CEO. Well, well. Those of us who ever read his stuff have come to expect this. No surprise.

Hey Chris, my friends in Philly really are looking for someone to mow their grass and be their gardener. At least this would allow you to make an honest living, for a change. And no doubt more $$$ than what you make now. IF you are healthy enough to do it that is.